Upon moving into residential aged care, you have the option of paying a Daily Accommodation Payment (DAP), a lump sum towards the Refundable Accommodation Deposit (RAD), or a combination of the two.

But what’s the best option?

Is it better to pay a RAD or a DAP?

To come to any type of conclusion, it’s important to first understand what a RAD and DAP are.

In This Article

What is a RAD and DAP in Aged Care?

A Refundable Accommodation Deposit (RAD) is an amount set by each individual aged care home, based on the location, quality of the home, services provided and the type of room.

A higher-quality residential aged care home will demand a larger RAD amount; whereas a more basic aged care home will have a lower RAD amount.

Furthermore, single rooms with their own ensuite will have a higher RAD than a shared room with a shared ensuite.

An aged care home must advertise the RAD amount for each room on their website or brochure.

Most RADs will range anywhere from $300,000 to $800,000, but there are some that will be below or above this range.

So, if that’s how a RAD works, what’s a DAP?

A Daily Accommodation Payment (DAP) is a payment required to be made on any unpaid RAD.

If a RAD is paid in full as a lump sum, then no DAP will be payable by an aged care resident. However, it is not compulsory to make a full payment towards the RAD. In fact, a resident does not need to make any payment towards the RAD.

But, if only a partial payment – or no payment at all – is made towards the RAD, then a DAP is payable.

The amount of DAP payable is calculated as the outstanding RAD, multiplied by the Maximum Permissible Interest Rate (MPIR), divided by 365, as shown in this formula.

DAP = (Advertised RAD – RAD Paid) x MPIR / 365

Any DAP is then paid as part of your monthly aged care bill, together with the Basic Daily Fee, any Means-Tested Fee and any Additional Services Fee.

So, how do you know whether you should make a full, partial, or no payment towards the RAD?

Is It Better to Pay RAD or DAP?

The four main factors in determining whether it is better to pay the RAD or the DAP are:

- The MPIR

- Affordability

- Age Pension Assessment

- Aged Care Fee Assessment

Importantly, once you have made a payment towards the RAD, you cannot withdraw it back again.

1. The MPIR

A large factor that will determine whether it is better to pay a RAD or a DAP will be the MPIR.

For the quarter commencing January 2024, the MPIR is 8.38% p.a. (Schedule of Fees and Charges for Aged care can be found here).

This means, unless you can generate a return on your capital in excess of 8.38% p.a. after tax, then it may be better to contribute as much as affordable towards the RAD.

This brings us to our next consideration – affordability.

2. Affordability

If you do not have adequate funds available to pay the RAD in full, then obviously this is not an option. But what if you can pay the RAD in part or in full?

Well, being able to pay the RAD in part or in full is a positive, but you still need to ensure that you have adequate funds remaining after making a payment towards the RAD to cover any monthly cash flow, future expenses, or emergencies.

Another benefit of contributing more towards the RAD is favourable Age Pension assessment.

3. Age Pension Assessment

Any amount paid towards the RAD is not assessed for Centrelink Age Pension Assets Test purposes and not deemed to earn an income for Income Test purposes.

Therefore, paying more towards the RAD (as opposed to a higher DAP) may result in higher Age Pension entitlements. You just need to ensure the amount contributed to the RAD is affordable.

In addition to Age Pension, paying more towards the RAD may also reduce Aged Care fees.

4. Aged Care Fee Assessment

The amount contributed towards the RAD is assessed under the asset assessment component of the aged care Means Tested Care fee, but not under the income assessment component.

Therefore, it may be possible to reduce the Means Tested Care fee by contributing more towards the RAD.

Let’s take a look at an example of how making payments towards the RAD affects the financial outcome. This can help you decide whether it’s better to pay a RAD or a DAP.

RAD vs DAP Aged Care Example

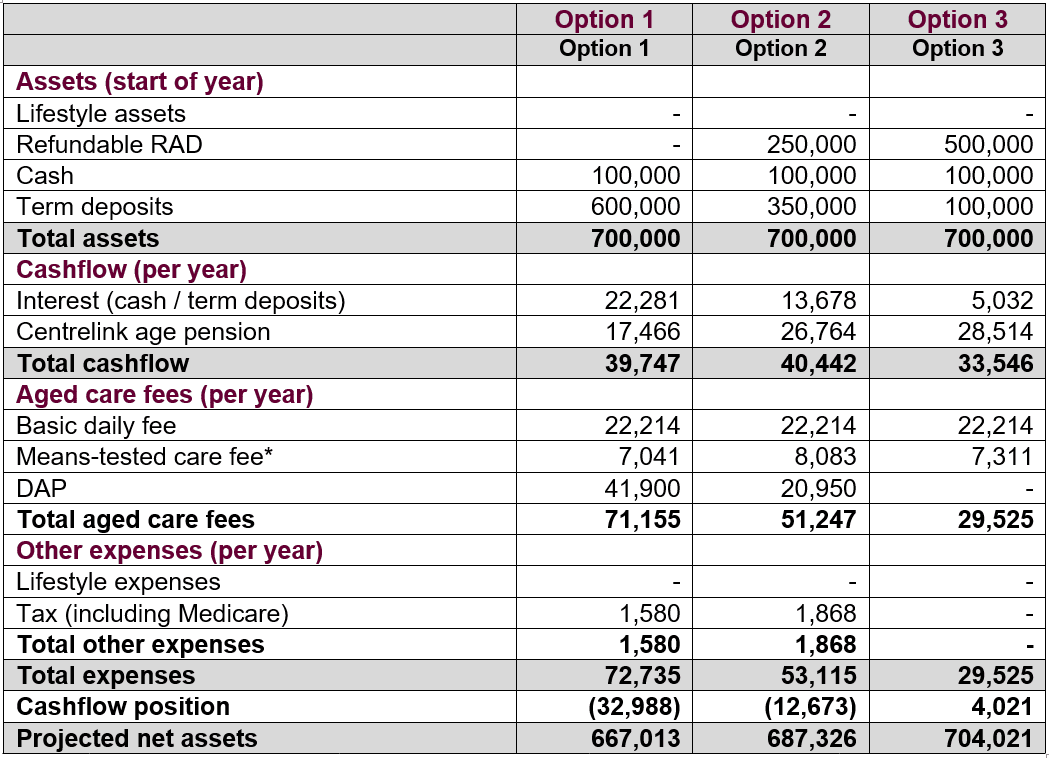

The table below shows an example of three scenarios when it comes to paying for a RAD or a DAP – or both, including how it affects Age Pension entitlements, aged care fees, and overall cash flow.

For this example, we will assume:

- A single person

- Non-homeowner

- Bank accounts of $100,000 (earning 1.5% p.a.)

- Term deposits of $600,000 (earning 3.5% p.a.)

- An advertised RAD of $500,000

- No Additional Services Fee

Each of the three scenarios will be:

- $0 (0%) paid towards the RAD

- $250,000 (50%) paid towards the RAD

- $500,000 (100%) paid towards the RAD

* Assuming the MTA assessment has been completed, the initial daily means-tested care fee (recalculated quarterly) is estimated as:

- Option 1 – $19.95 per day

- Option 2 – $22.43 per day

- Option 3 – $19.95 per day

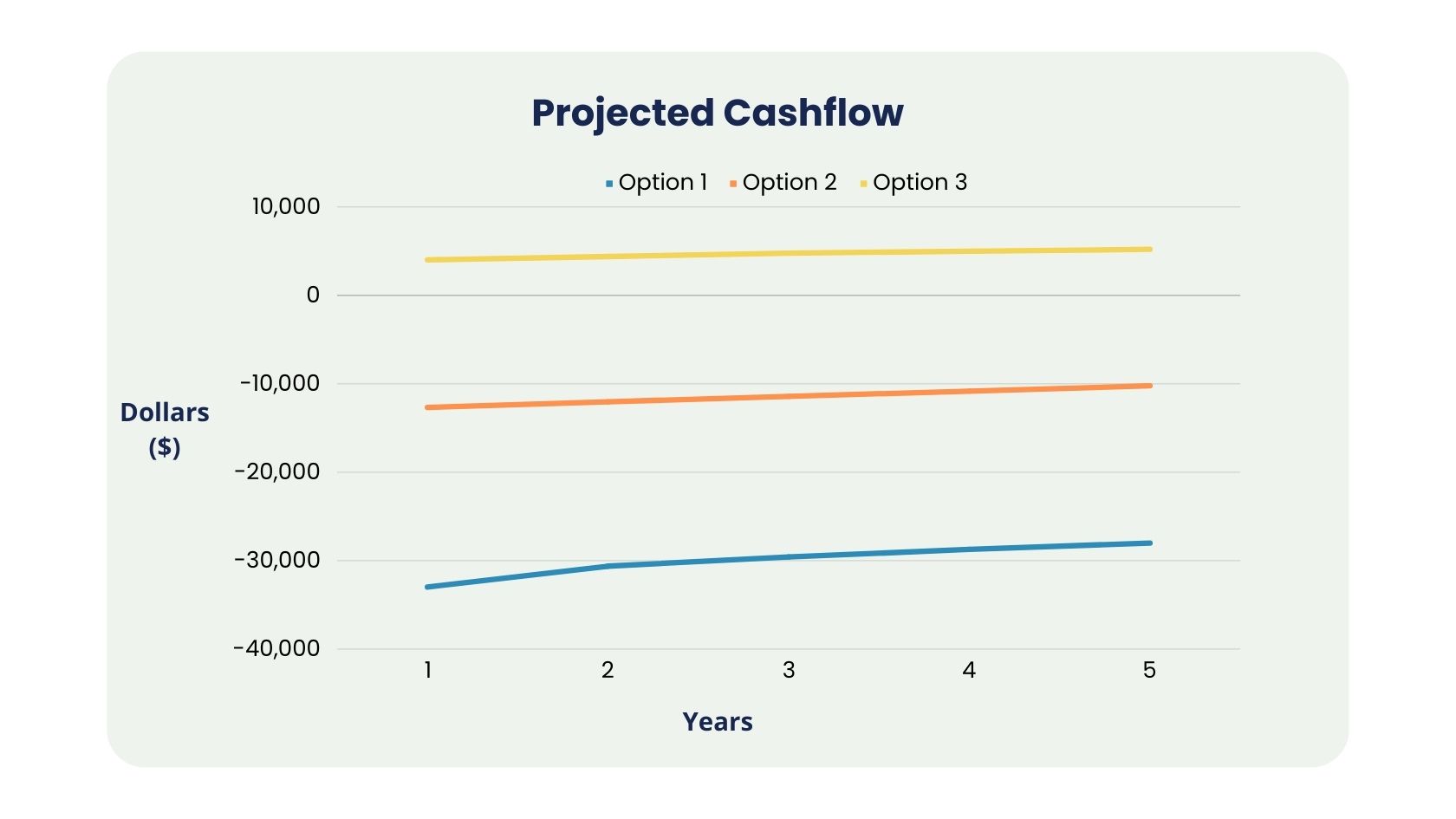

The following graph compares the projected cash flow outcomes over five years:

As you can see, in this example paying the RAD of $500,000 in full appears to be the most beneficial from a cash flow perspective.

It’s important to understand that the resulting cash flow and financial outcomes are highly specific to each individual, based on age, marital status, homeownership status, affordability, residential aged care home chosen, Age Pension eligible, family matters and estate planning issues, to name a few.

At Core Value Aged Care Advice we help families make the right financial decisions when transitioning a loved one from home or hospital into permanent aged care. If you would like to feel confident in the financial decisions you make when helping a loved-one into care, please call us on 1300 944 011 to speak to an expert aged care adviser.

You might also like:

Hi, I hope you found this article useful.

If you wish to discuss your situation and what strategies may be of benefit please contact us here

Thanks - Shane